Two Minute Drill--February 28

Bonds Don't Belong Here...

Bonds don’t belong here, and that’s a problem for stocks. Growth is too strong for an inverted yield curve. We are already at the longest curve inversion in history, and signs of recession are still nowhere to be seen. Yesterday, the Atlanta Fed GDP Nowcast was revised UP for the current quarter—to 3.2%!

If you asked any Fed official if growth of 3.2% was more likely to contribute to disinflation or inflation the answer would be obvious.

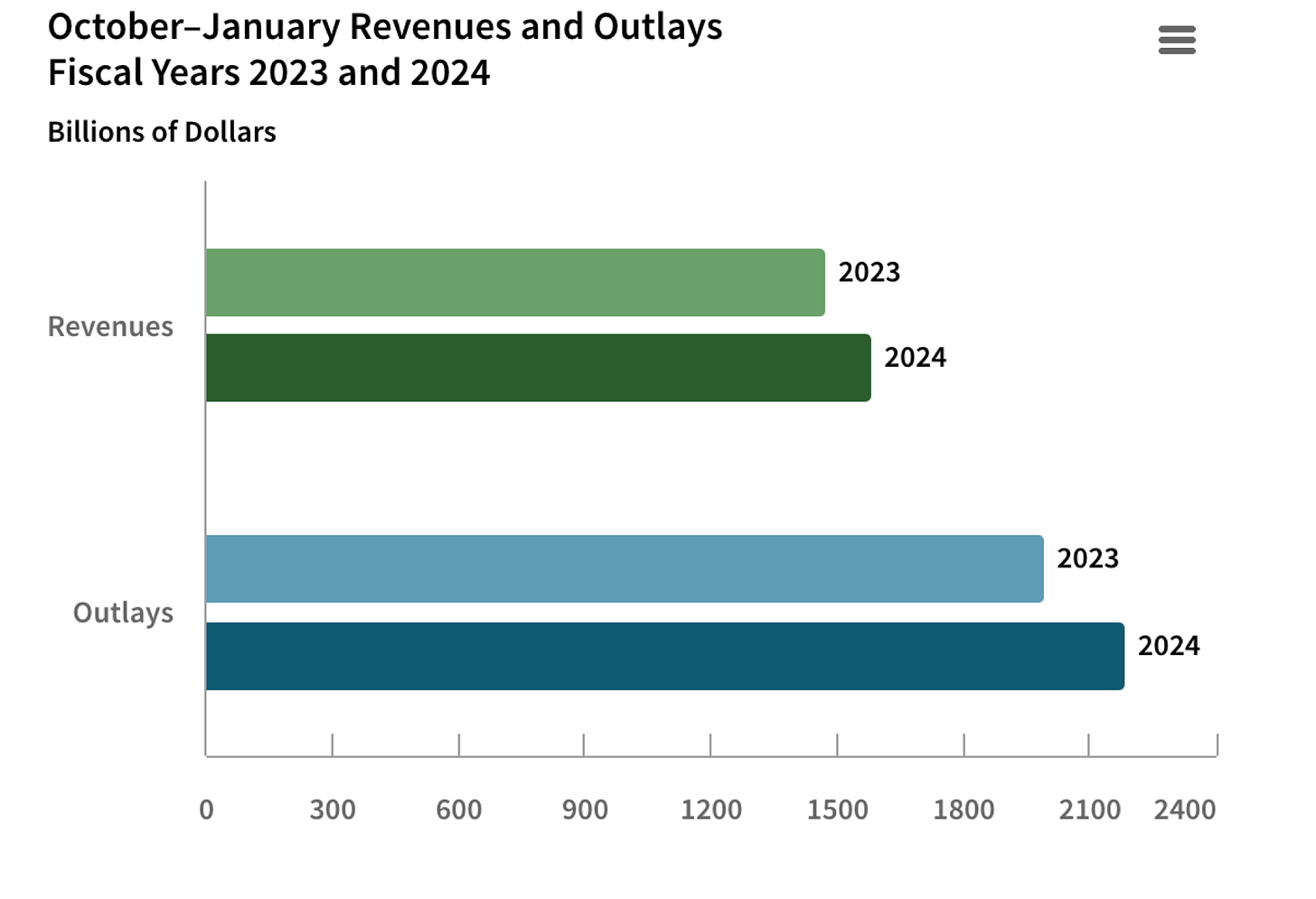

So far this fiscal year, the budget deficit is running $71 billion above last fiscal year. We never tire of pointing out that a deficit of this size is massively expansionary. All other things equal, real interest rates should be higher when running a deficit this large, not lower.

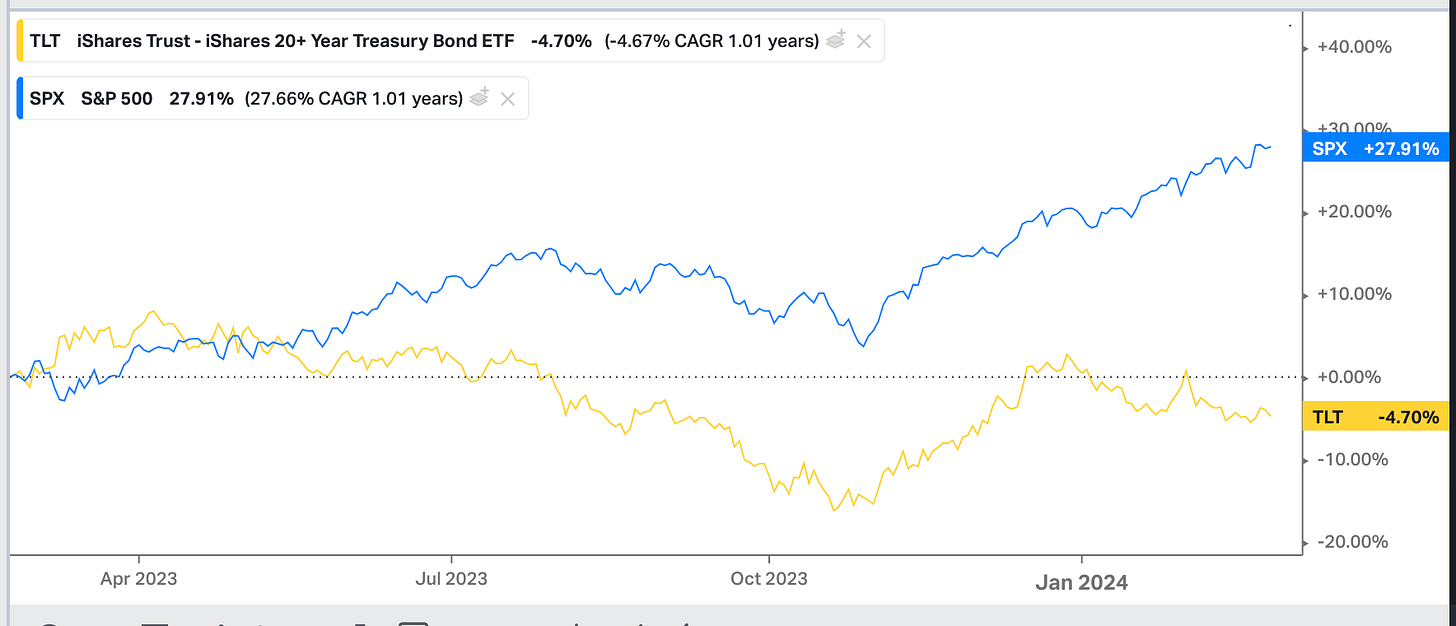

Over the past month we have made modest progress with dis-inverting the curve, but not much. Even if we get the priced in 3 rate cuts this year, long bonds would have to rise at least another 25 basis points to make a flat curve. And that assumes an orderly march to a normalized curve, which seems unlikely.

But does it seem like all the heavy lifting is done? Yields are still lower than they were three months ago!

So growth is very strong, the fiscal deficit is very large, and we have reduced market pricing on rate cuts from 6 to 3. But even 3 seems like a lot if you were to consider solely the rate of growth and the size of the deficit. While a rate hike that some have mused about seems unlikely, all of the work the market has done to get from 6 cuts to 3 still rests on shaky grounds.

Aside from the AI frenzy the market advance in general has been predicated on expectations of an easing of monetary conditions—even while actual financial liquidity conditions have been quite loose for some time (and are now stalling as we pointed out yesterday). That makes the path of bonds we think, the most important thing to watch when considering catalysts for a correction.